Prediction Markets and Why Classification Matters (More than Outcomes?)

Intro

Prediction markets such as Polymarket and Kalshi sit uncomfortably between finance, gaming, gambling and information markets. Their recent growth has less to do with regulatory blind spots and more to do with a genuine categorisation problem. These platforms do not map cleanly onto existing regimes and that ambiguity has shaped both their trajectory and the intensity of regulatory attention they attract. Rather than asking whether prediction markets are socially beneficial or politically problematic, a more productive lens is to examine how regulatory classification determines what these platforms are permitted to become.

The Discomfort

Prediction markets have grown quickly because they do not fit neatly into existing regulatory categories. They challenge long-standing distinctions between speculation and information gathering, entertainment and financial exposure. This discomfort has prompted uneven regulatory responses, with authorities reaching for familiar frameworks even where the underlying activity only partially aligns.

What Prediction Markets Actually Are

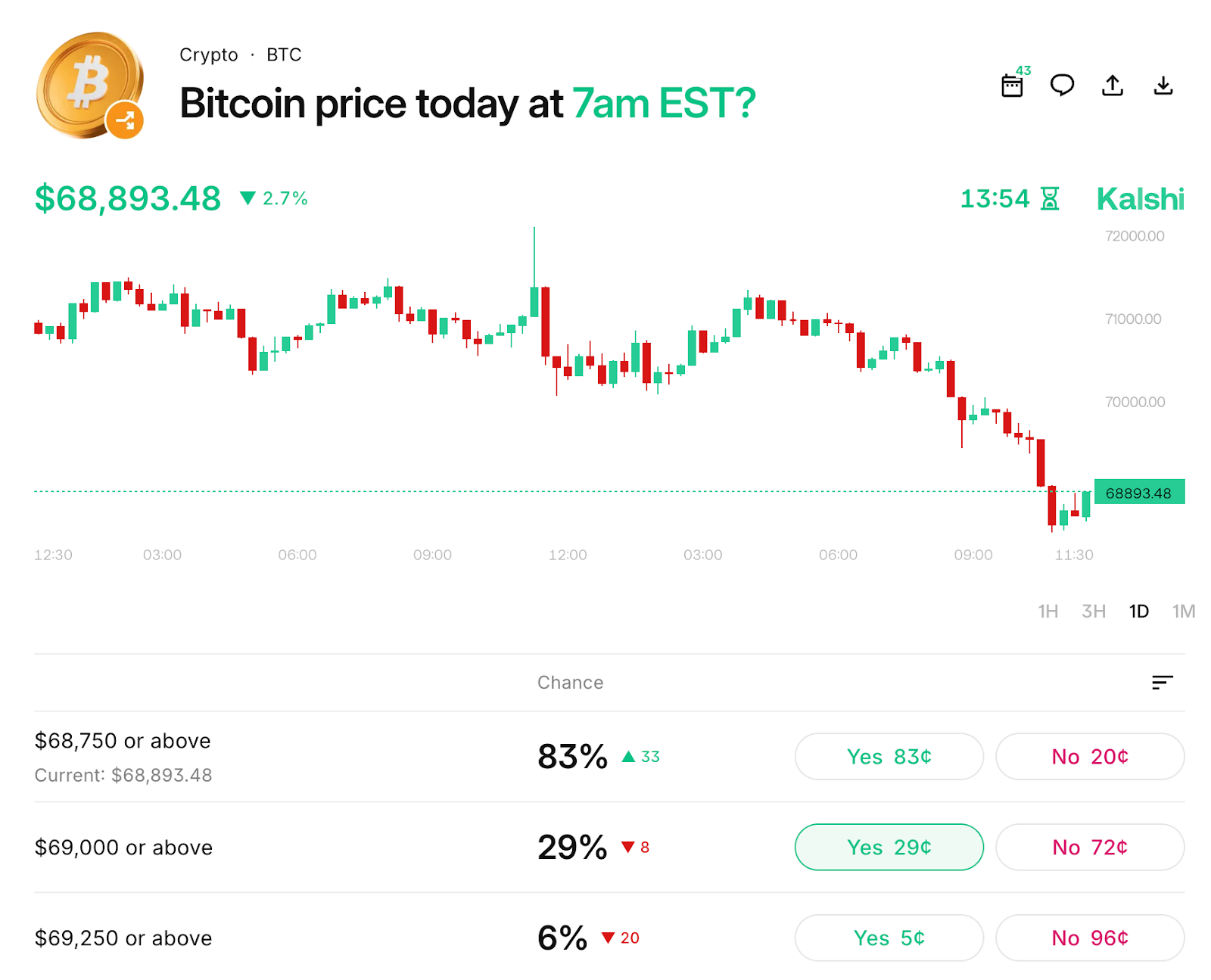

At their core, prediction markets translate probabilistic beliefs about future events into tradable positions, blending elements of financial instruments, information markets, gambling and behavioural incentives. Participants are rewarded for being right rather than persuasive, and prices function as aggregated signals of collective belief. This structure explains why prediction markets are often defended as tools for forecasting rather than gambling. However, the presence of monetary stakes introduces exposure, incentives, and potential harm that go beyond pure information aggregation.

"Prediction market contracts are structured as commodity derivatives (https://kalshi-public-docs.s3.amazonaws.com/kalshi_finance_faq.pdf) which are explicitly tied to events. In essence, they represent binary positioning opportunities for traders, though many contracts mirror traditional exchange-traded contracts in that they can be structured to reflect e.g. a hurdle rate above or below a contract would pay out.

..As commodity derivatives, rather than company-linked equity derivatives, they are not generally encompassed by insider trading rules or other restrictions, allowing financial professionals (in principle and making no assumptions about company-specific guidelines) to engage in these markets. A key difference between prediction markets and “traditional” betting is that the prediction sites are generally exchanges rather than market makers. Whereas betting companies generally take the opposing side of a bet that is placed, on prediction markets, positioning is matched by participants, prices and probabilities then settling at the clearing price & volume rather than otherwise defined algorithmic outcomes." - Ben, FRx CEO

The Classification Problem

The central regulatory challenge posed by prediction markets is not their subject matter, whether political, economic, or cultural, but their classification. Are they derivatives contracts, gaming products, or data-driven forecasting tools? Each framing carries different assumptions about risk, consumer protection, and market integrity. Classification is not a semantic exercise. It determines which regulatory body has jurisdiction, which rules apply, and which behaviours are treated as unacceptable.

Why Classification Shapes Everything Downstream

Once a market is classified, its regulatory destiny follows. Oversight authority, capital requirements, disclosure obligations, and enforcement mechanisms are all downstream consequences of that initial decision. A platform treated as a financial market is assessed primarily through the lens of systemic risk, market manipulation, and participant protection. A platform treated as gaming is regulated around fairness, addiction, and consumer harm. Information markets, by contrast, face far lighter scrutiny. The difficulty for prediction markets is that they borrow features from all three.

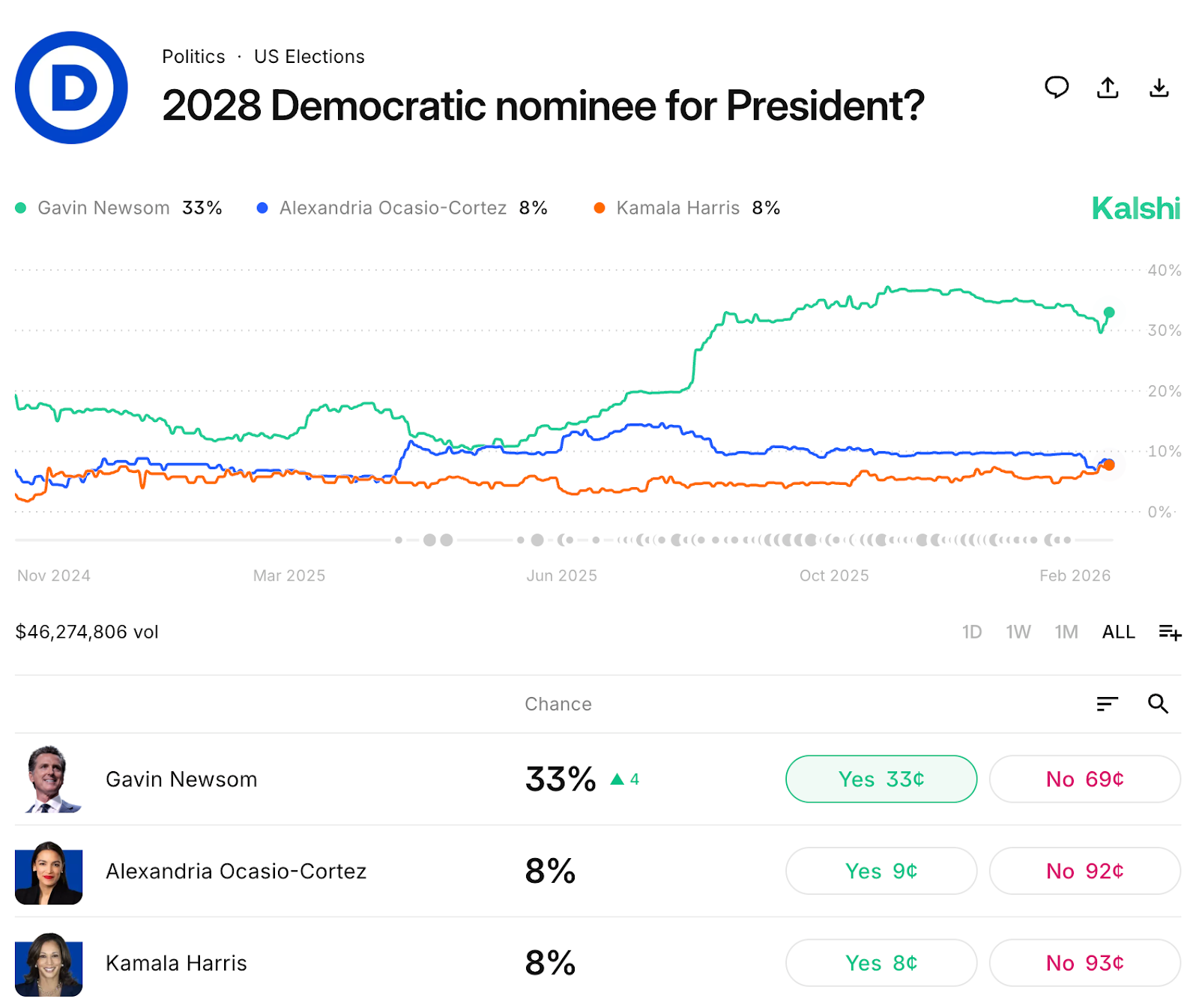

Polymarket and Kalshi as Contrasting Case Studies

The divergence between Polymarket and Kalshi illustrates how regulatory posture, rather than market design alone, shapes legitimacy and operational scope. Kalshi has pursued registration and approval under the US Commodity Futures Trading Commission, positioning itself as a regulated derivatives exchange. Polymarket, by contrast, has operated largely outside formal US regulatory approval, relying on decentralised infrastructure and offshore positioning. The result is not simply different compliance burdens, but different ceilings on growth, partnerships, and institutional participation.

The Role of the CFTC and Financial Logic

The involvement of the Commodity Futures Trading Commission reflects a broader regulatory instinct to prioritise financial risk and market integrity over the informational value of forecasts. From the CFTC’s perspective, the key questions concern leverage, manipulation, concentration of positions, and exposure to loss. Whether a market produces accurate predictions is largely irrelevant to this assessment. What matters is whether the structure creates incentives or vulnerabilities that could undermine confidence or cause harm.

"Given the rapidly increasing scale of these markets, they actively engage with regulators, as is their duty, to ensure proper handling of information and safeguarding against market manipulation. Large PMOs (prediction market operators) do not allow insider trading on their contracts in principle, and state that they actively monitor, much like most traditional exchanges, for suspicious activity. Given the reliance on crypto for trade financing and a degree of anonymity, this cannot be entirely ensured. However, it is important to keep in mind the typical / highest volume contracts on these exchanges, most of which focus on events that are either difficult or prohibitively expensive to manipulate by a single player. For example, while it is conceivable, many bets are simply not feasible to directly manipulate, except by parties to the outcome themselves." - Ben

A Note on the UK and EU Regulatory Posture

From a UK and EU perspective, prediction markets remain largely peripheral rather than explicitly addressed, but their underlying characteristics intersect with several existing regimes. In the EU, the focus remains anchored in financial classification through instruments such as MiFID II and, where applicable, market abuse frameworks. Prediction markets that resemble derivatives may therefore encounter regulatory scrutiny by extension rather than by design. The UK doesn’t have an explicit “prediction market” regulatory category; instead, most real‑money prediction markets are treated as gambling under the UK Gambling Commission’s regime (with binary / purely financial derivatives treated or restricted under FCA financial rules)..

While there is no bespoke regime for prediction markets, their operation would likely be assessed through a combination of financial services regulation, gambling law, and, increasingly, digital governance principles around consumer protection and platform responsibility. What is notable is the absence of clear guidance rather than the presence of active prohibition. This ambiguity creates space for experimentation, but also reinforces the likelihood that any future regulatory engagement will prioritise structural risk and governance maturity over the social or informational value of prediction itself.

Structure Over Outcomes

Whether prediction markets accurately forecast elections or economic indicators is largely secondary to how incentives, participation, and risk are structured. A market that produces accurate signals but concentrates exposure among a small group of actors presents a different risk profile from one that is widely distributed and tightly constrained. Regulatory attention therefore gravitates towards design choices rather than predictive success. This mirrors developments in other areas of digital regulation, where system architecture increasingly matters more than stated intent.

Boundary-Setting Over Endorsement

Effective regulation in this space is less about endorsing or suppressing prediction markets, and more about setting clear boundaries that align market behaviour with institutional risk tolerance. Clear classification allows regulators to articulate what is permitted, what is prohibited, and where responsibility lies. It also gives market operators a clearer basis on which to design compliant products, rather than operating in a perpetual state of ambiguity.

Closing

Prediction markets ultimately test whether modern regulatory systems can accommodate hybrid instruments without forcing them into ill-fitting categories that obscure rather than manage risk. As these platforms continue to evolve, the central question is not whether they are good or bad, but whether regulatory frameworks are capable of recognising their complexity without defaulting to blunt analogies. Classification, more than outcome, will determine their future.